Nominal and Real Dollar Concerns for Farm Profits

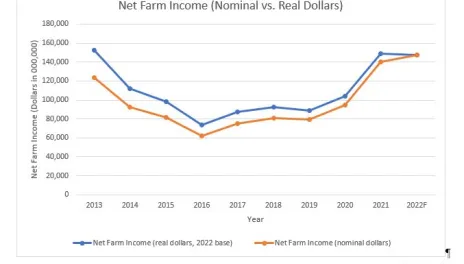

USDA’s Economic Research Service (ERS) publishes estimates of net farm income several times throughout the year. On September 1st, their estimate showed a 5.2% increase in net farm income for 2022 from 2021. Net cash income is expected to increase 15.1% and production expenses are expected to be 17.8% higher than they were for 2021.

While a higher net farm income is desirable for the farm sector, it is important to note that these are nominal dollars. The numbers show a different picture when adjusting for inflation. ERS’s inflation-adjusted analysis forecasts that net farm income decreases by 0.6% from 2021 to 2022. At the same time, production expenses are forecast to increase by 11.3% for 2022 from 2021 when adjusted for inflation. More information about national farm sector profitability can be found at: https://www.ers.usda.gov/data-products/farm-income-and-wealth-statistics/data-files-u-s-and-state-level-farm-income-and-wealth-statistics/.

It's important to consider inflation-adjusted, or real, dollars when making financial decisions. The “buying power” of dollars decreases when inflation is high—we get less for more. Higher expenses in real dollars indicates that the dollars received for commodities don’t go as far for buying inputs such as feed, fuel, and fertilizer. A concern with high inflation is that while net income increases in nominal dollars, future buying power is not increasing as fast as expenses.

As 2022 comes to a close and planning for 2023 begins, it is important to understand the high inflationary times. Current farm output prices are good, historically, but expenses are at extremely high levels. According to ERS, when adjusting for real dollars, and looking back 50 years, expenses haven’t been this high except in 2012 – 2014.

Paying attention to costs will likely be extremely important for the next year or two. Costs do not tend to fall the same as commodity prices, especially land costs. The high income due to improved commodity prices and large government payments crop farmers have received over the last three years have increased land costs. Rent is unlikely to fall anytime soon, and high land costs generally translate to large land payments that can become oppressive when incomes fall.

A final concern about falling real income is that net worth falls. Net worth, or equity, is the retained earnings the farm has earned over time to provide for retirement, expansion, or successive generations. While this can increase due to market conditions usually due to increases in market land values, it is desirable to grow this from actual farm profits. Falling real farm income can cause real losses in retained earnings that are difficult to grow if incomes don’t increase. Paying attention to costs while maintaining good production is especially important during the current high inflation period.

Jason Fewell, Ph.D.

Jason.Fewell@lrsc.edu

ND Farm Management Instructor