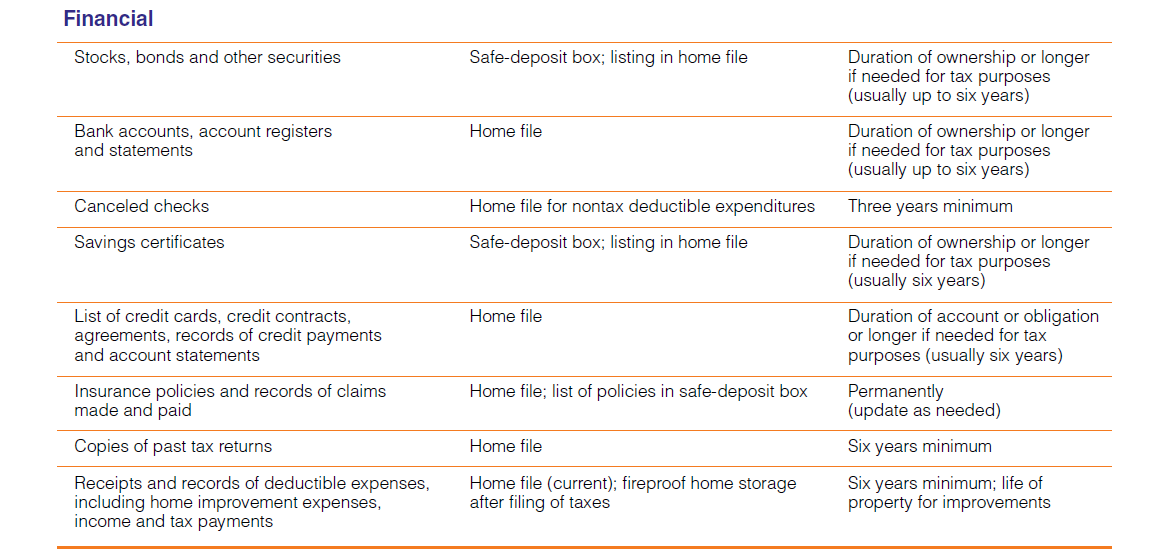

The Internal Revenue Service (IRS) has a three-year statute of limitations on auditing a return. Keep all records of income or deduction expense for three years.

However, if you use the income averaging option available to farmers, you may need to prove your taxable income for four base years.

If you failed to report more than 25 percent of your gross income, the government will have six years to collect the tax or start legal proceedings.

Filing a fraudulent return or failing to file a return eliminates any statute of limitations for an audit by the IRS. If you hire a tax specialist, check to see how many years you should keep your records.

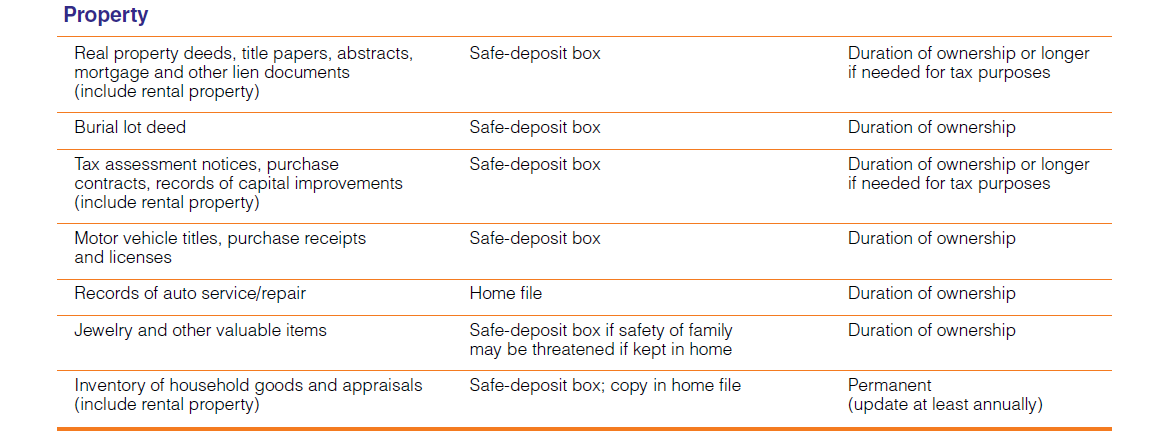

Keep records that show the original cost or value of your property. Also keep a record of home improvement costs to reduce capital gains tax if your home, land or property ever is sold for more than its original cost or value.

All canceled checks are not needed to support tax deductions. Save only those checks that substantiate an income tax deduction, such as checks paying for medical/dental expenses or charitable contributions.

Putting a “T” for “tax” in the memo blank of a check when you write it might help you sort canceled checks faster. In cases where your only record is a duplicate check, you may need the monthly checking account statement to verify that the check went through.

Keep a copy of filed tax returns. Should you need it, a prior tax return copy can be obtained from the IRS at irs.gov.

Taxpayers have two easy and convenient options for getting copies of their federal tax return information – tax return transcripts and tax account transcripts – by phone or mail.

A tax return transcript shows most line items from the tax return (Form 1040, 1040A or 1040EZ) as it originally was filed, including any accompanying forms and schedules.

It does not reflect any changes you, your representative or the IRS made after the return was filed. In many cases, a return transcript will meet the requirements of lending institutions, such as those offering mortgages and student loans.

A tax account transcript shows any later adjustments either you or the IRS made after the tax return was filed. This transcript shows basic data, including marital status, type of return filed, adjusted gross income and taxable income.

Request transcripts by calling the IRS or ordering by mail using Form 4506-T, Request for Transcript of Tax Form. Specify the type of transcript you are requesting. The IRS does not charge a fee for transcripts, which are available for the current and three prior calendar years. Allow two weeks for delivery.

If you need a photocopy of a previously processed tax return and attachments, complete Form 4506, Request for Copy of Tax Form, and mail it to the IRS address listed on the form for your area. The IRS charges a fee of $50 for each tax period requested. Copies generally are available for the current and past six years. Allow 75 days to receive your copies.